More and more companies are looking to cryptocurrencies as an investment refuge from the inflation we have been experiencing recently. Holding a company’s entire cash position in cash as it depreciates at close to 10% per year does not make sense. In addition, there may be orThere are several reasons why companies decide to buy cryptocurrencies, the most common of which are:

- Some suppliers require payment for their products or services in virtual currency.

- Part or all of employee compensation is paid in tokens issued by the company itself.

- Cryptocurrency mining companies

- Investment funds that operate with cryptocurrencies

Be that as it may, the reality is that more and more companies are buying cryptocurrencies.At Modo Cripto, we have been allocating part of our treasury to the purchase of cryptocurrencies for years and helping other companies to carry out the same process, which we have defined in these five stages:

- Sign up with a recognized exchange house or exchange,

- Transfer funds

- Buy cryptocurrencies and

- Move them into an escrow application to secure the funds.

- Selling cryptocurrencies and withdrawing the euros back to a bank

The process can take several weeks depending on how fast we are in providing the requested information. It is not an intuitive process at all and that is why we wanted to explain everything you should take into account before starting it. That said, we assume that you are fluent in English, since you will have to register on platforms that do not have customer service in Spanish.

If this is not the case or you are in a hurry, there are cryptocurrency exchange agents located in Spain that have a much more personalized and agile process when acquiring cryptoassets. The famous Peer to Peer market. In addition, their commission is around 2% on the market price, a commission that is not far from the big exchanges such as Binance, Coinbase, etc… If this is an option that interests you, get in touch with us. contact us for more information.

Well, without further ado, let’s start with the process to be carried out:

Register with a recognized exchange house.

Our recommendation is to go to a recognized exchange house that guarantees the necessary security standards.

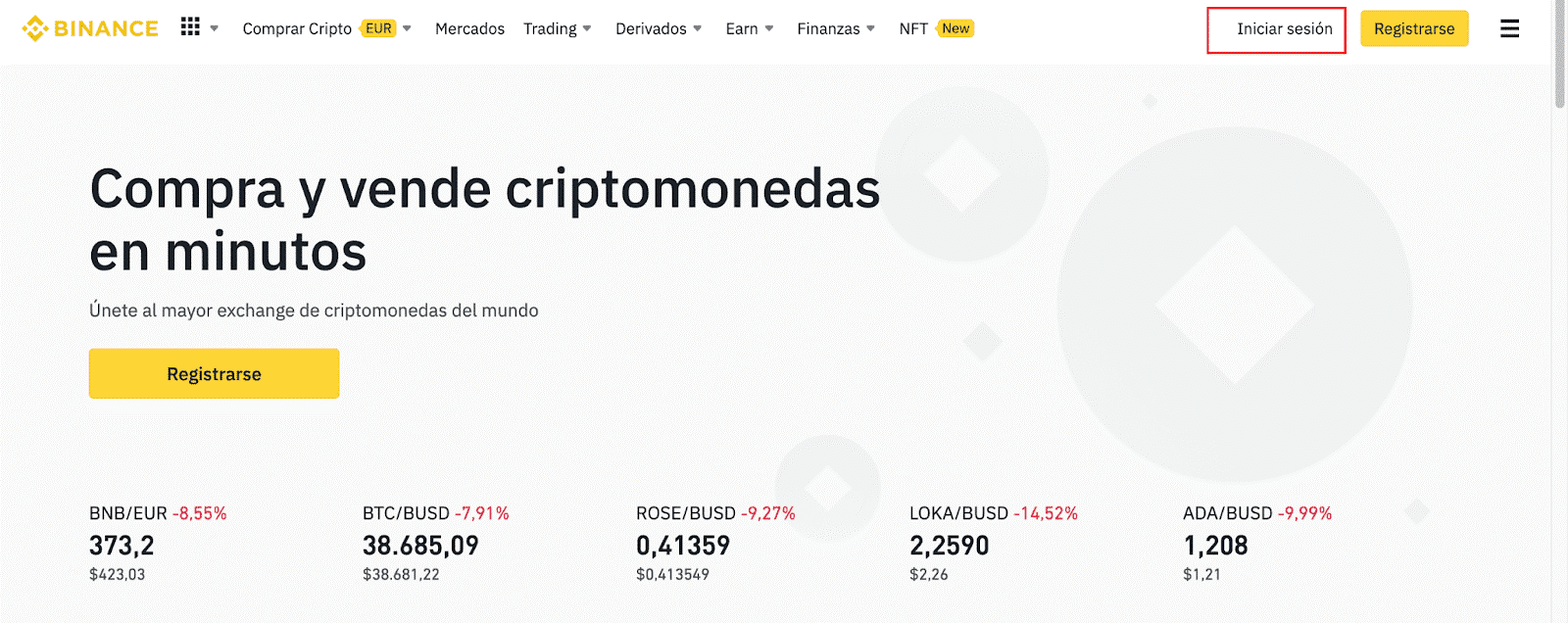

The first thing to do is to create an account on the exchange. Our recommendation is that the person who is going to perform this process is one of the persons who is going to be a proxy within the corporate account. Once the account is created and before going through the Know Your Customer, KYC process, i.e. sending a photo of our ID and so on, we must apply for the corporate account. In the case of Binance:

i) Click on [Iniciar sesión] on the Binance home page.

Go to [Perfil]and click on [Identificación], then select[Verificación de entidad] to start.

Go to [Perfil]and click on [Identificación], then select[Verificación de entidad] to start.

And this is where you will have to provide a myriad of documents and notarial deeds of your company, as well as create new documents and deeds as required. Keep in mind that the documentation you must provide often does not have an equivalent in Spanish law, so you will need to understand what they are asking for in order to provide a valid equivalent.

If the application is rejected do not despair, in the cases we have handled, an application has been rejected several times, due to lack of information, or because the information provided did not meet the standards. In any case, patience and above all, keep an open channel of communication with the exchange manager who must approve or deny the application, so you will know exactly what you must provide. This can be the most cumbersome step, if you are stuck at any point, you can contact us and we will help you to complete the application properly.

One of the steps that you must take into account is that you must provide photographs of the ID cards of each of the attorneys-in-fact of the account and justify their powers of attorney through notarized documents. It is important to make sure that you take good photographs, as in some cases, we have been denied requests for black and white copies. Don’t despair, you are getting closer.

Transfer funds

Once you are registered, you will want to transfer funds in euros in order to purchase the cryptocurrencies. As of today you have two options, either through a credit card, with a 2% commission, which is excessive, or transferring funds through an intermediary, which in the case of Binance is Adv Cash, a financial entity located in Belize. If you want to save the 2% commission you will have to register again in Adv Cash going through a very similar process.

ImportantDo not attempt to transfer funds from your bank account to Adv Cash without registering as a company. If you do so, the transfer will be returned to you after a week with a more than significant commission. This is because the name of the sender of the transfer must be exactly the same as the name of the Adv Cash account.

To register in Adv Cash you will be asked for some of the information you have already provided to register in Binance, plus a bank statement from your current bank account of the movements of the last three months, where you can see your IBAN, name of the company and must also be stamped by the same bank. In one of the cases we completed, after more than 30 mails, we were even asked about the color of the stamp on the bank statement, here is the proof, so again, be patient.

Once we are registered with Adv Cash, what we need to do is to deposit the funds from our traditional bank to Adv Cash as an international wire transfer. Adv Cash is a trading company located in Belize, but the bank account of the bank to which we are going to make the transfer from a Spanish bank is located in Lithuania.

Adv Cash’s platform is not yet available in Spanish, but its operation is quite similar to that of a cryptocurrency exchange. You must go to your account, click on deposit funds and follow the instructions on the deposit pdf document that you will generate.

The transfer will take about three working days to reach Adv Cash. Once we receive the funds we can easily transfer them to Binance, the process is immediate and no commission will be applied.

Buy cryptocurrencies

We could say that this is the simplest step. Once the funds are received in our exchange, the operation is exactly the same as if we were operating a personal account. We will have to select the market in which we want to operate and enter our purchase order, once the transaction is executed we will have the cryptocurrencies in our wallet within the exchange.

Transfer cryptocurrencies to an application or physical custody location to secure the funds.

Once we have purchased the cryptocurrencies, we must transfer them to an application where they are safe. While there is growing confidence in popular exchanges such as Binance or Coinbase, there is always the possibility of being hacked. Imagine if a group of hackers managed to break the security of an exchange like Binance, the reward would be enormous. Because the incentive is so great, there is a lot of interest in carrying it out. This is why, for diversification purposes, we can always keep our cryptocurrencies in wallets of custody applications, where more than one person has access to such funds. The same parallels exist for WordPress websites. As WordPress is so widely used by so many companies, it is a CMS that has a high potential reward for being hacked and therefore vulnerabilities are constantly being detected. The same is true for large exchanges.

Looked at another way, imagine you are the CEO of a company, the only one who has access to the wallet that holds the company’s funds, and you are the only person who knows the secret key to that wallet. The risk is enormous, if something happens to you. This is why it is necessary to have key recovery systems in case of any unexpected contingency.

There are many ways to custody cryptoassets depending on the degree of security you want to provide. We have distinguished two main groups of custodians, looking at the methodology followed by companies with large investments in this type of assets:

- Physical custody: In this case, cryptocurrencies must be stored in a ledger or a hard wallet. Once they are stored as such, the hard wallet needs to be stored in a safe kept by a third party, usually a bank. Access to this safe, it is important to require at least two proxies within the company. In this way we apply an additional layer of security of double signature, in addition to having the guarantees that if something were to happen to either of the two proxies, the mechanisms established by Spanish law would give the possibility of being able to recover the keys, going to the beneficiaries of the will.

- Digital custody: There are a large number of companies that, through applications, are dedicated to the custody of cryptocurrencies. These applications allow you to assign the keys to your wallets and establish deposit and withdrawal policies. For example, it can be established that two, three, four or as many people as necessary must approve the withdrawal of funds. There are many skeptics who disagree with this type of custody, since one of the maxims of bitcoin is that if you do not have the access keys to a wallet, they are not your bitcoins. However, the market acceptance of this type of solution is evidence that there is a need in the market, and that it is absolutely necessary to have systems that mitigate risk when it comes to the custody of cryptocurrencies.

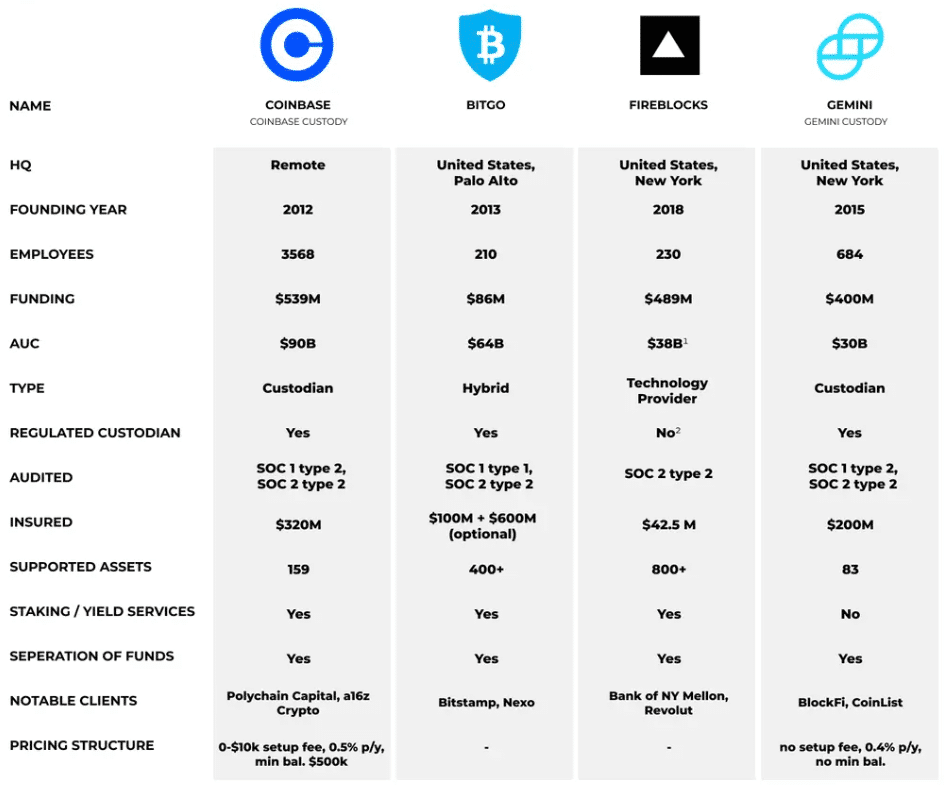

The most popular applications on the market are: Coinbase, Bitgo, Fireblocks, Gemini among others. The price of these solutions depends mainly on the number of licenses. Furthermore, in some cases there is an initial setup fee, in addition to the monthly recurrence. We leave you a comparative chart below so you can see the process we have followed.

That said, there are smaller enterprise solutions that are more affordable. We have looked at CYBAVO, which costs approximately 150 euros per month and has all the functionalities detailed by the major custodian companies. Definition of deposit and withdrawal policies, multiple signing of different licenses, etc… In addition, we highlight the use of this application for its ease of use and intuitive interface. Attached is a screenshot for you to see an example of a deposit approval process that goes through the necessary signature of three proxies in the same step, within the transaction approval matrix.

Selling cryptocurrencies and withdrawing the euros back to a bank

This case is just as simple as if we operate with a personal wallet, in the sense that we will need to send our cryptocurrencies from a cold or hot wallet, depending on the custodian system we have chosen, to an exchange, there we will issue an order to sell our cryptocurrencies to euros and then we will issue an order to withdraw cash from the exchange to our bank account. If we have done the process with Binance and Adv Cash, the withdrawal of funds is free of charge.

Finally, as you carry out the corresponding operations, you must save all the information and provide it to the company’s accounting department, so that it can record the operations at the corresponding valuation. Finally, you should keep in mind that there will be different accounting treatments depending on the use you make of your cryptocurrencies. You will have to account for them under fixed assets or as an inventory, depending on whether it is a long-term investment or if it is part of the company’s activity, such as a cryptocurrency investment fund.